Some will end up paying a little less, and some will break even.

But even those policies can vary by state when it comes to how long the exemption is in effect. Instead, those people will pay taxes to the state where their employer is located, like normal.

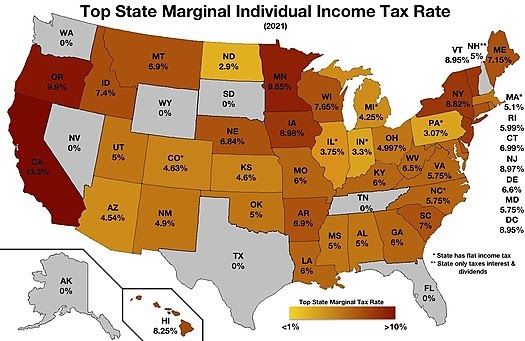

They’ve said they won’t tax workers who’ve relocated there temporarily due to the pandemic, according to the American Institute of CPAs. Thirteen states and the District of Columbia have addressed the 2020-specific situation. Some, like Pennsylvania and New Jersey, already have reciprocity agreements because so many people typically commute from one to the other. Often, a taxpayer gets a credit from their home state for taxes paid to another, but it doesn’t always make them whole. Other places would tax only after a 30-day stay. In some places, workers could owe taxes to their temporary state after just one day of work. For example, if you live in Virginia but are working remotely from a family home in New York this summer, you may have to pay income tax to both states.īut it all depends on where you are relocating. That’s because some states tax income earned there even if the person primarily resides and works in a different state. For the many people working remotely during the pandemic, next year’s tax season could get complicated if they’re sheltering in place in a different state.

0 kommentar(er)

0 kommentar(er)